The price of diesel fuel will play a heightened role in transportation rates in the next couple of years. Fuel costs are always an important indicator of over-the-road (OTR) shipping costs, but a perfect storm of events will make diesel prices more important than ever before.

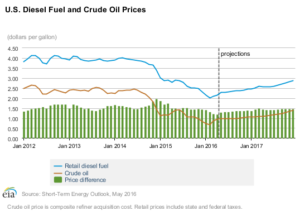

As of June 2016, diesel fuel is $2.382 per gallon on average –a high for the year. Fuel prices are expected to rise for the rest of 2016 and throughout 2017. Under normal circumstances, this would lead to rate increases due to higher fuel surcharges, but the next few years in the freight industry are far from normal, and a few different outcomes are possible.

Obstacles in Transportation

To see the impact of diesel prices on transportation rates, it’s first important to understand the many challenges facing OTR carriers. These obstacles all affect efficiency and profitability for trucking companies, consequently affecting rates.

- Regulations. The hours of service (HOS) mandate has been highly controversial, the most debated provision of which is currently suspended for further review, but the HOS ruling has the potential to severely limit carriers’ time on the road. The electronic logging device (ELD) mandate is possibly just as controversial and will take effect in 2017. This regulation will require expensive investment and implementation in new technology to track truck drivers’ hours.

- Driver shortage. While the shortage of drivers has yet to impact carriers in any meaningful way, it is getting harder, and more expensive, to recruit and retain truck drivers. More drivers are retiring every year, while very few are entering the industry to replace them. This means higher salaries for current drivers, and more investment in recruitment tactics to attract new talent.

- Mediocre freight volume. The economy has been slowly but steadily recovering for a few years now. Current truck capacity levels have been just enough to cover demand. Carriers haven’t had the pricing leverage they’d hoped for – a strong economic recovery would have led to far higher demand for trailer space, forcing shippers to outbid one another for regular capacity. Now, the short-term economic future is uncertain and carriers are hesitant to raise rates.

- Equipment investments. In addition to ELDs, most OTR carriers are using old equipment that needs to be replaced. The total cost of owning a commercial vehicle went down by 14% in 2015. This means that, with lower operating costs, right now is as good a time as ever for carriers to replace trucks and trailers. There’s a reason carriers are operating with old equipment – new equipment is expensive. Carriers, although experiencing a rare investment opportunity due to low diesel prices, will still have to shoulder an immense load of paying for new trucks and trailers.

Diesel Comes into Play

While it’s typically safe to assume higher diesel prices will lead to higher rates, that’s not always the case. Fuel surcharges are negotiable, and a recent study shows that only 41% of carriers expect to increase rates in 2016. On the other hand, transportation analysts say shippers should expect a 3% to 5% increase in base rates in the next 12 months.

There’s a lot of conflicting information due to the high level of uncertainty in economic forecasts. Carriers are left unsure of what to expect in the near future, which makes predicting their rates very difficult.

It is most likely that through the rest of 2016, and possibly into 2017, carriers will be able to shoulder the load of rising diesel prices. Consulting firm FTR predicts favorable market conditions for shippers during 2016 and some of 2017.

Recently, carriers have been making significant time investments in training their employees to be experts in their field. Carrier executives claim this has made positive impacts on efficiency. On top of this, shippers have been very receptive to the notion of being a preferred shipper in anticipation of capacity shortages, which further boosts productivity.

Efficiency improvements mitigate the impact of regulations and capital investments, but mediocre freight volume still forces carriers to keep prices low, putting a cap on profit margins which are currently razor thin.

Looking further ahead, carriers will reach a tipping point, late in 2017 or possibly in 2018, where costs must be passed on to the shipper. For shippers, now is the time to lock in transportation rates.

Transportation rates will rise regardless of economic conditions, but diesel will play a role in various ways.

If the economic recovery gets into full swing, rates will rise due to limited capacity. Diesel prices may inflate these costs even more. As regulations, the driver shortage and equipment costs start to affect carrier efficiency, they will need to find a place to make up revenue. Historically, fuel surcharges have been used as a source of revenue when possible, and it’s likely carriers will resort to this when operating costs rise, despite the overall rise in rates.

If the economy never quite picks up or even falls into recession, transportation costs will still rise. Without competition for trailer space, carriers have to compete for freight by lowering their costs as much as possible. This will be very difficult to do as diesel approaches $3 per gallon and above, and current transportation obstacles become more challenging to overcome. Carriers may not be able to use their fuel surcharge as a significant source of revenue in this scenario, but they will be passing on operating costs to shippers so they can maintain their thin margins.

The bottom line is this: expect rates to rise within the next few years, and keep a close eye on diesel price projections, as they will have a major impact on the level of transportation rate increases.

Request Free Logistics Opportunity Assessment